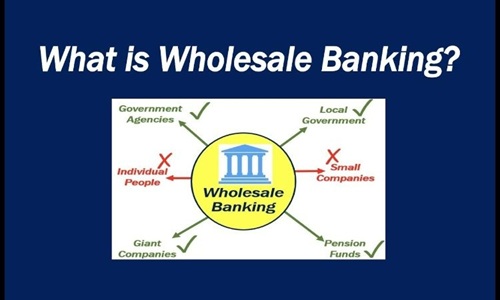

In many developing countries, businesses are growing at a quick pace and, therefore, demand increased support from financial institutions. It is in this realm that Wholesale Banking acts. It is engaged in working with these large companies, governmental bodies, or other institutions in their financial needs. So, wholesale banking essentially is about working with big money and big clients. This space provides a lot of opportunities in emerging markets but also some grave threats.

Helping Businesses Grow

One of the crucial things Wholesale banking does is to provide the larger businesses with tools for their growth, including loans, foreign exchange, trade financing, and treasury solutions. Companies engaged in the import or export of goods would find this kind of banking support essential. These services would also allow assisting the business in cash flow management, investing in new projects, or operating more smoothly day to day.

Fostering Economic Development

Wholesale banks enable entire industries for growth by elevating industries to avenues of funds that are not otherwise easily available. This can result in the upliftment of infrastructure, manufacturing, and service sectors in developing countries. Incipient development of businesses and more job creation would strengthen the local economy. Hence, wholesale banking is reckoned as an engine for economic development.

Opportunities in New Market

Being less competitive among banks in emerging markets enables the entry of new players and opportunities for growth. These markets are thriving with young companies needing funding to realize their potential. Thus, it is time for these wholesale banks to establish early relations and become trusted partners of these companies as they grow.

Potential Challenges and Risks

Where there is potential, wholesale banking in emerging markets also faces risks. One big risk is political instability. It encompasses everything from change of government to sudden changes to policies that may affect the very operating legality of the bank. There are also inflationary, foreign exchange, and weak legal system risks, each potentially capable of creating a crisis for the bank and its customers.

Another area has been credit risk. Many of these companies do not have extensive credit histories, or in some cases, any history at all, thus making it difficult for banks to assess their willingness and ability to repay the loans. Without hard financial data, banks must be extremely cautious concerning to whom they lend money, and how much.

The Need for Strong Regulation

Fair and transparent rules are needed to protect both the banks and their clients. Countries must institute strong banking regulations that prevent fraud and limit risk. At the same time, such regulations should not hinder business development or growth. A balanced approach creates confidence and keeps the banking system on a nutritious footing.

Conclusion

Gross banking will significantly benefit the emerging markets in business growth and development in the market. The banks should become aware of the risks and adequately prepare strategies to manage those risks. In the right hands, wholesale banking is a good way to return for the development of a country’s finance.