America’s Unclaimed Property Map – Where Lost Money Concentrates

America has $70+ billion of unclaimed property, but it does not evenly cover the map, with the tech corridors of the Pacific Northwest and the oil fields of Texas. Rather, it is concentrated in bold regional patterns that expose higher realities about migration, industry and household finance. Certain places generate a higher concentration of unclaimed property because of how people live, work, and move. Coastal hubs accumulate abandoned securities and escrow funds, while energy-driven states inherit dormant accounts from boom-and-bust cycles. Meanwhile, rural and border regions carry distinct challenges linked to mobility, industry, and cross-border commerce. Examining this “geography of lost money” uncovers both economic stories and policy lessons. This article explores which U.S. regions hold the most unclaimed property and the forces shaping these concentrations, insights that can inform policymakers, advisors, and households alike.

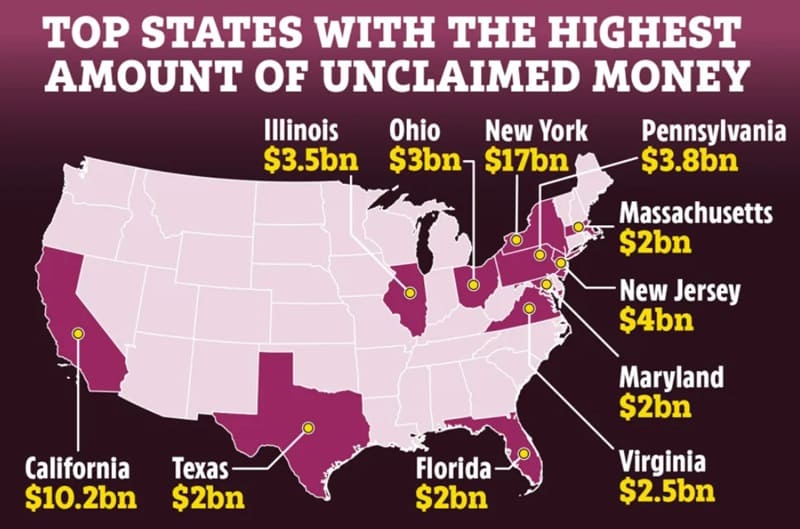

Figure. Map highlighting the U.S. states with the largest amounts of unclaimed money, led by New York ($17B), California ($10.2B), and New Jersey ($4B).

The Wealth Corridors: Why Coastal Regions Lead in Unclaimed Property Volume

Coastal regions, particularly the Northeast corridor and the Pacific Coast, dominate in sheer unclaimed property volume. The Northeast’s dense financial hubs, stretching from Boston through New York and down to Washington, D.C., have long been centers of wealth creation and turnover. Complex portfolios, high property transaction volumes, and interstate commuting patterns lead to forgotten accounts, dividend checks, and escrow balances.

On the Pacific Coast, the technology sector and entertainment industries generate an equally intricate financial ecosystem. A high salary, numerous sources of income, compensation based on stock, and a high number of moves in the career leads to perfect conditions of abandoned securities and payroll checks. Crowded cities also intensify the problem: high populations of metropolitan statistical regions such as Los Angeles, San Francisco, and Seattle translate into increased total concentrations of unclaimed resources.

It is also dependent on the cost of living. In costly areas families often have more than one financial account to deal with, in terms of mortgages, rent and savings. In cases of relocation or change of job, small yet valuable assets are usually neglected and millions of dollars lie unutilized in the state agencies.

The Industrial Heartland: Manufacturing and Energy State Patterns

It is a different story with the industrial and energy heartlands of the U.S. The Rust Belt had a history of slumbering pension funds, severance accounts, and employee stock plans as a result of the long-term stagnation of heavy manufacturing. Corporate restructurings and plant shutdowns dispersed workers all over, and archaic benefit systems lost track of their beneficiaries.

Energy states in Texas to North Dakota have distinctive trends that are associated with oil, gas and mining periods. Boom years bring rapid influxes of workers, new businesses, and payroll surges; bust years leave behind abandoned paychecks, royalty rights, and utility refunds.

Agricultural states add another layer. The seasonal and migrant farm workers tend to leave wages unclaimed and casual nature of the periodic cycles of the commodities also leaves forgotten cooperative dividends. Migration of the population makes the issue even more acute: younger generations moving out of the industrial or rural place often leave behind them smaller accounts with the local banking and credit unions.

Collectively, these trends emphasize how economic changes in the shift to manufacturing to services, resource booms to recessions directly transform into concentrations of unclaimed property geographically.

The Growth States: Sun Belt and Population Boom Regions

The Sun Belt from the Carolinas to Texas, Arizona and into Nevada is an active image of unoccupied property. The population increases, both due to local migration and to international immigration generate high rates of turnover in housing, banking and employment. Retirees moving south often leave dormant accounts in their previous states, while young professionals frequently shift between metropolitan hubs.

Military installations across the South add another factor. Regular personnel rotations, combined with large defense industry payrolls, contribute to forgotten accounts and unclaimed insurance benefits. Tourism economies in Florida, Nevada, and Arizona create similar challenges, as seasonal workers and temporary residents abandon small but numerous assets.

The complexity of tracking assets across rapidly growing regions with high population turnover is why resources like Claim Notify have become essential for Americans navigating multi-state relocations and the unclaimed property that often results.

In short, the Sun Belt’s rapid growth and transient populations amplify the risk of forgotten property, creating one of the fastest-rising regions in the unclaimed property map.

Rural vs. Urban: The Geographic Divide in Unclaimed Property Types

While urban regions dominate in raw numbers, the nature of unclaimed property shifts dramatically between city and countryside. In urban centers, volumes are higher but often concentrated in financial accounts: payroll checks, securities, escrow balances, and utility refunds. Urban density means greater account complexity, but also stronger infrastructure for eventual recovery.

In rural America, unclaimed property looks different. Agricultural assets, mineral rights, and small cooperative dividends frequently go unclaimed. Limited access to banks and digital financial services increases the risk of abandonment. Healthcare debt and insurance refunds also appear disproportionately in rural records, reflecting access disparities.

Population density plays a decisive role: on a per-capita basis, some sparsely populated counties exhibit surprisingly high rates because of abandoned land-based property. Ultimately, the rural-urban divide underscores that unclaimed property is not just about volume but about the types of assets tied to each region’s economic base.

Border States and International Commerce: Unique Geographic Factors

Border states reveal yet another dimension of America’s lost money map. Cross-border commerce along the Mexican and Canadian frontiers generates complex cases of unclaimed property, from payroll checks for temporary workers to escrow funds tied to international real estate. Immigration patterns add further complexity, as visa holders and temporary residents often leave behind small accounts when returning home.

Tourism plays a major role in states like Nevada, Arizona, and Texas, where international visitors generate refund checks or abandoned deposits. Similarly, universities in border states host large international student populations who may unknowingly abandon deposits, tuition refunds, or housing balances.

Trade corridors, major highways, ports, and railways also contribute to higher volumes of corporate unclaimed property tied to logistics and transport firms. These factors show how global connections shape regional property abandonment, making border states a distinct category in the national map of unclaimed assets.

Understanding America’s Geographic Money Map

The geography of unclaimed property is more than an accounting issue; it is a mirror of America’s economic and demographic transformations. Coastal wealth corridors generate high-value abandoned assets through financial complexity, the industrial heartland reveals legacies of decline and transition, and the Sun Belt reflects the churn of rapid population growth. Rural and border regions, meanwhile, highlight the influence of economic structure and international mobility.

For households and advisors, recognizing these regional patterns is the first step toward prevention and recovery. Tools like ClaimNotify help bridge the gap, making it easier to navigate the multi-state complexities of America’s unclaimed property landscape.